Global Inflatable SUP Market Outlook: What B2B Buyers Should Know

Jul 31, 2025

Leave a message

The inflatable stand-up paddle board (iSUP) industry has grown from a niche segment to a global phenomenon over the past decade. In 2025, this growth is reaching new heights as consumers continue to seek outdoor activities that combine health, sustainability, and adventure. Whether it's a serene paddle across a quiet lake, a yoga session in a calm bay, or touring down scenic rivers, inflatable paddle boards have unlocked accessible and versatile ways for people to enjoy the water.

For B2B buyers-such as outdoor sports retailers, e-commerce sellers, rental operators, and emerging brands-the inflatable SUP boom presents a unique and timely opportunity. However, competition is also intensifying. To make smart decisions, buyers must understand not just the products, but the global supply chains, shifting consumer preferences, pricing trends, and innovative technologies shaping this space.

This guide dives deep into everything a B2B buyer should know in 2025 to thrive in the global iSUP market. Throughout, we'll introduce Ridewave, one of the most trusted and progressive inflatable SUP manufacturers, known for their low MOQs, OEM/ODM services, and fast, reliable delivery.

Market Size and Growth Projections

The inflatable SUP market has seen double-digit growth in multiple regions from 2020 to 2024. In 2025, this expansion is continuing as more people worldwide embrace paddle boarding as an accessible form of recreation and fitness. According to recent market reports, the global iSUP industry is projected to exceed USD 3.5 billion by 2027, growing at a compound annual growth rate (CAGR) of over 10%.

Several macro trends are fueling this growth:

Wellness and Outdoor Lifestyle: Consumers are prioritizing physical and mental health, driving interest in solo outdoor activities like paddleboarding.

Eco-tourism and Adventure Travel: Destinations offering stand-up paddle experiences are rising, especially in Europe, Southeast Asia, and Oceania.

Social Media and Visual Appeal: Paddleboarding is inherently Instagrammable. Scenic SUP images on social platforms drive desire and demand.

Inflatable Tech Advancements: Lighter, stiffer, and more durable boards have made inflatable SUPs a practical choice for casual users and serious paddlers alike.

B2B buyers should note that the iSUP market isn't just growing-it's diversifying. Sales are no longer dominated by all-round boards alone. Touring, racing, fishing, and yoga-specific boards now make up a larger portion of the market.

Key Regions Driving Demand

The global iSUP market isn't uniform. Demand patterns vary significantly across continents and countries, shaped by geography, culture, and consumer preferences.

Europe: Countries like France, Germany, Spain, and Italy are among the largest consumers. European buyers prefer stylish, eco-conscious boards with subtle design aesthetics. Touring boards and hybrid SUP-kayaks are also in high demand.

North America: The U.S. and Canada remain mature but fast-moving markets. Recreational all-round boards dominate, but there's a rising trend for performance boards for surf and fitness.

Asia-Pacific: Australia, Japan, and Thailand are showing rapid adoption. Lightweight, compact boards for travel and recreation are particularly popular.

Middle East and South America: These emerging markets are seeing increased interest in paddle sports as tourism infrastructure expands.

Ridewave understands regional preferences and tailors product lines accordingly. For example, in Germany and Poland, Ridewave's reinforced touring boards with double chambers are top sellers, while in Spain and Greece, colorful all-round boards dominate.

Top B2B Buyer Segments

The inflatable SUP space supports a wide range of B2B buyer types, each with distinct needs and expectations.

Outdoor Retail Chains: These buyers demand high inventory volume, attractive margins, and brand-recognized designs. Packaging design and retail display support are essential.

SUP Rental Businesses: Rentals need rugged, easy-to-maintain boards that withstand heavy use. Repairability, fast inflation, and stable platforms are top priorities.

E-Commerce Sellers: Logistics, packaging weight, and fulfillment compatibility are vital. SKU clarity and visual appeal on marketplaces like Amazon or Shopify are key.

Private Label / Start-Up Brands: Entrepreneurs often want low MOQs, full customization, and brand ownership. They seek suppliers who can offer ODM support, samples, and marketing collaboration.

Ridewave provides tailored solutions for each segment. Their in-house team handles packaging design, private labeling, and offers sturdy accessories for rentals, ensuring every B2B partner gets what they need to succeed in their niche.

Regional Market Breakdown

North America

The U.S. remains the largest market for iSUPs, with demand concentrated in California, Florida, the Great Lakes region, and Pacific Northwest. Canada is also showing strong growth, especially in British Columbia and Ontario.

Europe

Europe leads in product diversity and design innovation. France, Germany, the UK, Spain, and the Nordics are all robust buyers. Many brands here seek high-end customization and environmentally conscious designs.

Asia-Pacific

Australia, Japan, and South Korea are key players in the Asia-Pacific market. Australia, in particular, has a thriving water sports retail and rental ecosystem.

Emerging Markets

Latin America and the Middle East are newer markets, with growing tourism industries driving iSUP demand.

Ridewave Advantage: With a flexible production model and experience shipping to over 50 countries, Ridewave can customize specs to meet different regional standards and consumer tastes..

Product Trends: What Buyers Want in 2025

Today's B2B customers are more informed and demanding. The most successful products in 2025 share some key traits:

Lightweight but Durable Construction

Double-Layer PVC or Fusion-Laminated Materials

Bold Custom Graphics and Brand Identity

Tool-Free Quick Inflation Valves

Modular or Smart Accessories (e.g., mountable cameras, storage cases)

Designs featuring wolves, tribal prints, minimalist geometric patterns, or ocean motifs are especially in demand.

The Rise of Inflatable vs. Hard Boards

Inflatable SUPs are now dominating the market, accounting for over 70% of retail sales in some regions. Reasons include:

Easy storage and portability

Airline check-in compatibility

Improved stiffness and stability due to dual-chamber tech

Safer for beginners and families

Hard boards still hold value for racing and professional surfing, but even athletes are shifting to inflatables for training purposes.

Ridewave Technology: As inventors of the first and second-generation dual chamber systems, Ridewave boards outperform many hardboards in stiffness testing while remaining portable.

Understanding Buyer Segments

To succeed in the B2B iSUP space, you must understand your target segment:

Rental Operators

Looking for bulk orders, strong durability, fast delivery, and easy repairability.

Outdoor Retailers

Seek innovation, aesthetic design, eco-packaging, and storytelling for showroom appeal.

Brand Creators

Need end-to-end OEM/ODM support with logo printing, accessories, box design, and even social media material.

Ridewave Solution: We offer white-label, private-label, and full-service OEM production with low MOQs and short lead times.

Supply Chain Considerations in 2025

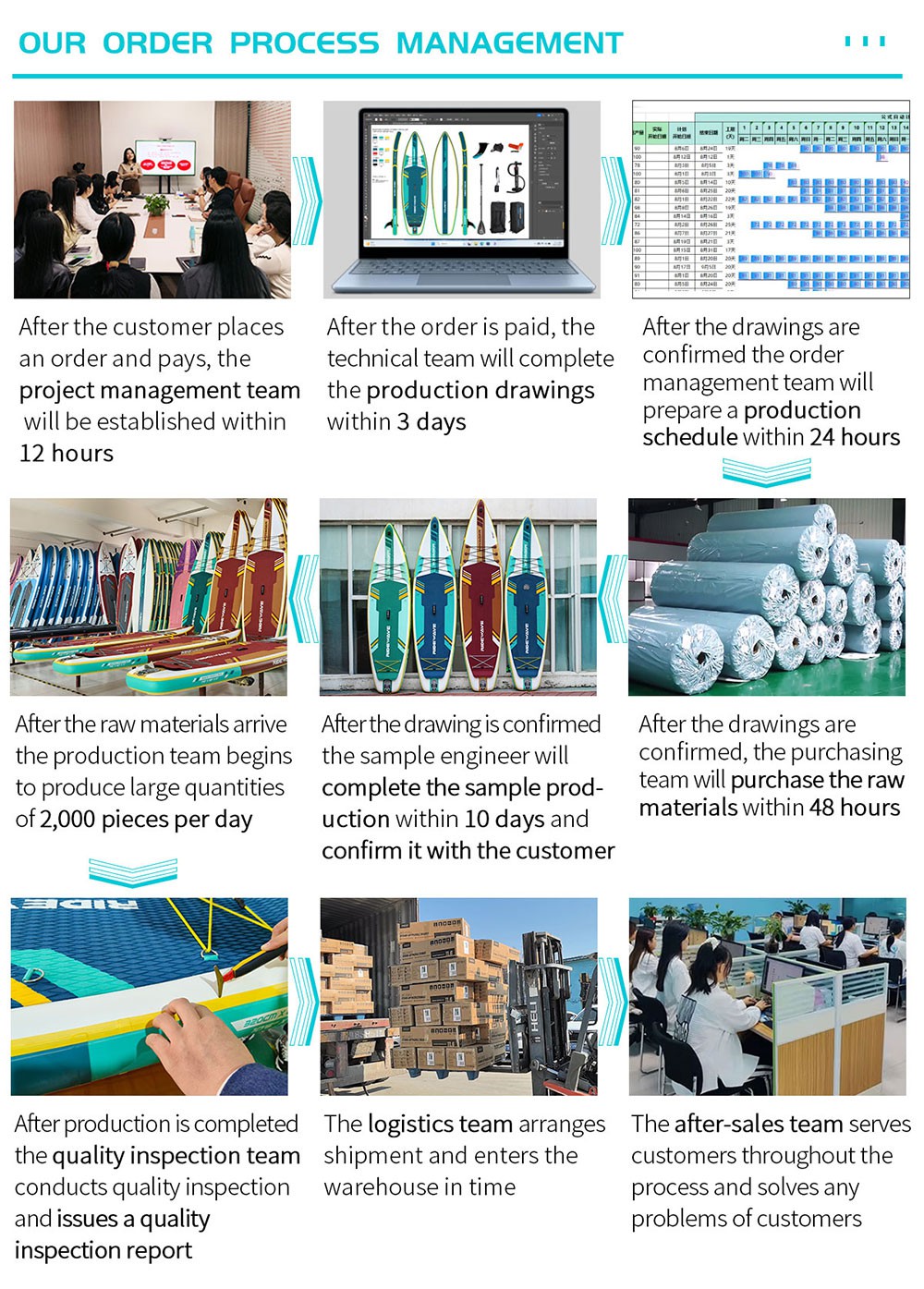

Lead Time Expectations

Standard production lead time is 30–45 days for most factories. However, during peak seasons (March–June), it can extend to 60+ days.

MOQ Trends

Low-MOQ manufacturing is now a competitive edge. Many small-to-medium brands want 50–100 pcs per model.

Freight & Logistics

Inflatable boards are typically shipped via ocean in standard cartons (1–2 boards per box). Ridewave optimizes container loading using tailored packaging geometry.

Key Certifications and Quality Standards

Buyers should look for suppliers who meet or exceed the following:

ISO 9001 factory management systems

CE/EN safety certifications (especially in Europe)

UV-resistance and saltwater exposure testing

Pressure testing to 18–22 PSI

Ridewave's quality management includes full inspection before shipment and optional third-party audits.

Branding & Customization as a Competitive Edge

Today's brands must differentiate, and customization is the most effective strategy. Ridewave offers:

Custom shapes, colors, textures

Logo printing and full-surface graphics

Brand packaging (eco-boxes, QR-coded manuals)

Matching paddle, leash, fin, pump sets

Case Example: A small French outdoor brand grew 3x in 2 seasons by switching to Ridewave's ODM model.

Digitalization and the Rise of Online B2B Buying

Digital transformation is reshaping how B2B buyers source inflatable SUPs worldwide. More distributors, wholesalers, and importers are switching from traditional trade fairs and in-person visits to online platforms, digital catalogs, and supplier marketplaces. This shift is not only about convenience but also about faster decision-making and transparency.

For instance, Alibaba, Global Sources, and even specialized water sports B2B platforms are now crowded with listings from Chinese and international SUP manufacturers. However, not all suppliers are created equal. The digital age has made it easier to access a wide range of options, but it has also increased the risk of scams, misleading product claims, and quality inconsistencies.

Ridewave stands out as a digitally mature brand. It offers:

A well-organized website with clear product specifications and OEM/ODM options

Transparent certifications (CE, ISO, SGS, etc.)

Regular online showroom updates

Fast online response times and multilingual sales support

These elements make Ridewave an ideal digital-first partner. Whether you are a buyer in France or Canada, you can screen, communicate, and negotiate remotely, and Ridewave's team ensures timely video calls, sample inspections, and digital contracts to reduce risk.

Design Trends and Customization Needs in 2025

The inflatable SUP market has shifted from "basic and blue" to stylish, expressive, and brand-aligned. In 2025, more retailers are demanding custom artwork, branded color palettes, and market-specific design elements to differentiate in crowded showrooms and online listings.

Key design trends include:

Nature-inspired graphics: Waves, mountains, wildlife, and minimalist silhouettes

Local motifs: Nordic patterns for Scandinavia, Maori symbols for New Zealand, or beach vibes for the Mediterranean

Matte textures & color blocking: High-end finishes that attract premium buyers

Gender-specific collections: More demand for SUPs that appeal to women paddlers or kids

Ridewave offers full customization support:

In-house graphic team to translate your concept into real, print-ready artwork

Multiple printing technologies (silkscreen, heat transfer, digital sublimation)

Access to 30+ color choices for EVA deck pads, side rails, handles, and backpacks

Packaging, manuals, repair kits and accessories - all customizable under your logo

Regulatory Compliance and Logistics Challenges

As inflatable SUPs become regulated like sporting goods or maritime equipment in some countries, compliance is now non-negotiable for B2B buyers. Different markets have different requirements:

EU (France, Germany, Spain): CE certification, REACH compliance, EN ISO standards

North America (Canada, USA): CPSIA for youth models, labeling requirements, ASTM standards

Australia/NZ: Product Safety Australia regulations

Middle East: Customs declaration requirements, special inspection for PVC imports

A reputable manufacturer should offer:

Up-to-date test reports

Clear material traceability

Labeling/marking that meets local requirements

Ridewave leads in this area. Every product is shipped with a compliance pack including test certifications, factory audit reports, and digital copies of required documents for customs clearance.

Beyond compliance, logistics is also key. Inflatable SUPs are large in volume but light in weight - this creates unique shipping challenges.

What B2B Buyers Should Do Now: Strategic Moves for Success

Given the explosive growth and transformation of the inflatable SUP market, B2B buyers should act proactively and strategically in 2025. Here's what to prioritize:

✅ Start With a Niche Strategy

Don't try to sell everything. Focus on a specific market segment like:

Rental centers (durable boards, quick inflation)

Women/kids' SUPs (lighter, easier handling)

Premium touring boards (longer boards with cargo features)

Adventure/fishing boards (with mounts and storage capacity)

✅ Build a Modular Product Line

Work with your supplier to create a family of boards using shared parts (like valves, handles, and EVA pads) but different sizes and designs. This gives the feel of a large collection with less inventory risk.

✅ Invest in Branding

Your logo, color theme, packaging and accessories matter more than ever. Stand out in stores and online with a cohesive identity.

Ridewave can help with all of the above - from design files to logo stamping, from branded backpacks to custom hang tags.

✅ Order Early, Scale Smart

Plan 2-3 months ahead. Use small trial orders (MOQs as low as 30 boards) to test market reactions before scaling.

✅ Think Long-Term Partnership

Avoid switching factories every season. Partnering with a stable, communicative, and growth-oriented manufacturer like Ridewave will save you time, cost, and mistakes.

| Related Reads You May Enjoy Looking to dive deeper into specific markets or strategies? Check out our other in-depth guides: 1.Top Countries Where Paddle Boards Are Booming in 2025 2.How to Customize Your SUP Brand: Colors, Prints, Packaging & Accessories That Sell 3.Why More Paddle Board Distributors Are Choosing Ridewave in 2025 4.OEM vs. ODM: Which Is Better for Your SUP Business? 5.How to Build a Paddle Board Brand: The Ultimate B2B Success Roadmap Each post explores the challenges and best practices B2B buyers face in a specific area-don't miss them! |